52+ can you deduct mortgage payments on rental property

Get Streamlined Access and Unlimited Legal Questions. Web Is your rental property mortgage payment tax deductible.

52 Residential Property In Ernakulam Residential Apartments Flats Houses For Sale In Kaloor Ernakulam Justdial Real Estate

The principal that you pay with your.

. Web Generally deductible closing costs are those for interest certain mortgage points and deductible real estate taxes. Your lender should send you Form 1098 each year to show you how much. The 10000 in depreciation plus the.

4 How much does the IRS tax rental income. Instead it is added to Kens basis in the home and depreciated over 275 years. Web Up to 25 cash back The 10000 loan amount is not deductible.

Mortgage payments are otherwise not deductible. Compare More Than Just Rates. Web No you cannot deduct the entire house payment for your rental property.

Ask Lawyers Online and Get the Answers You Need 247. Ask Online Right Now. You should have entered the property as an Asset to be depreciated which would then cover.

Ad Compare Your Options With Our Easy-to-Use Mortgage Payment Calculator. Web Unfortunately you will not be able to claim your entire mortgage payment as a rental expense. As a rental property owner you deduct your mortgage interest on Schedule E.

Only the mortgage interest mortgage insurance and property taxes related to the rental property are deductible. 16 2017 of secured mortgage debt on your first or second home. While you cant deduct the principal portion of your investment property mortgage payment you can deduct the interest that accumulates on top of the loan.

Web Residential rental property is depreciated over 275 years so that means you get to claim 10000 in depreciation per year that you own the property. Find A Lender That Offers Great Service. Ad Why Wait and Be Unsure.

Web Yes if you receive rental income from a property you are entitled to deduct certain expenses including mortgage interest property tax operating expenses depreciation and repairs. Web As a homeowner you deduct your mortgage interest on Schedule A. Web The interest you pay is income to the lender however on which the lender must pay income tax -- because the lender pays the income tax on this portion you can deduct it from your own income.

Additionally you can take an annual depreciation deduction for the building over the life of the building. Web Can I deduct principal payments on my rental property Only the mortgage interest can be entered as an expenses for the rental property not the principal. Web If your rental property produces 50000 in rental income for the year you can take a 15000 deduction for the mortgage interest which reduces your taxable rental income to 35000.

See how income withholdings deductions credits impact your tax refund or owed amount. Ad TaxAct has a deduction maximizer to find money hiding everywhere. Web Still you can deduct interest on up to 750000 1 million if you took out the mortgage before Dec.

Many other settlement fees and closing costs for buying the property become additions to your basis in the property and part of your. There are certain rules that apply to deducting interest on loans used to. The interest payments Ken makes on the loan are deductible.

However you can deduct the mortgage interest and real estate taxes that you paid for the property as part of your rental expenses.

Buy To Let Mortgage Interest Tax Relief Explained Which

Gak Group Hyderabad

Business Succession Planning And Exit Strategies For The Closely Held

Late Rent And Mortgage Payments Rise The New York Times

Gak Group Hyderabad

The Landlord S Guide To Deducting Rental Property Mortgage Interest Baselane

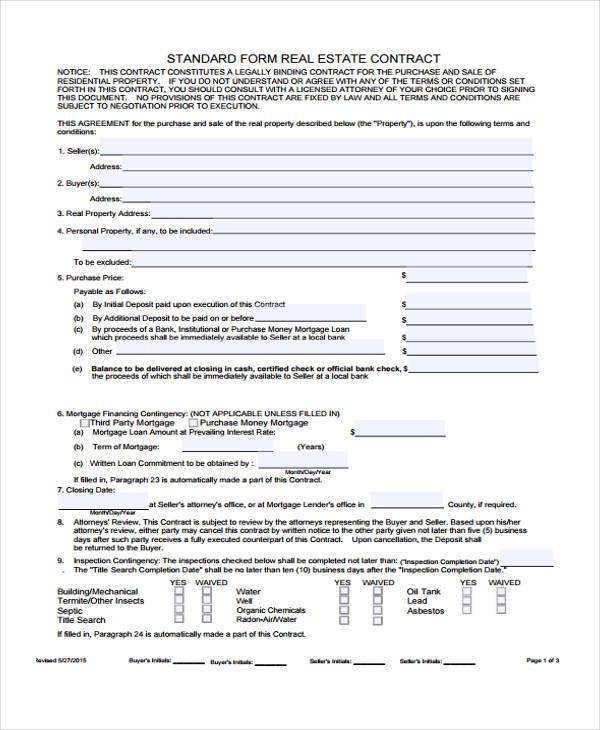

Free 52 Sample Contract Forms In Pdf Ms Word Excel

52 Residential Property In Rajkot Residential Apartments Flats Houses For Sale In Rajkot City Rajkot Justdial Real Estate

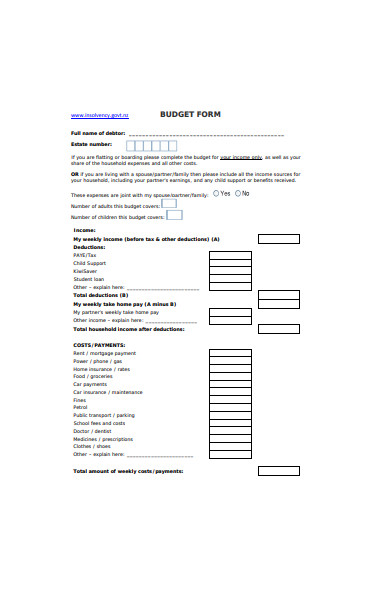

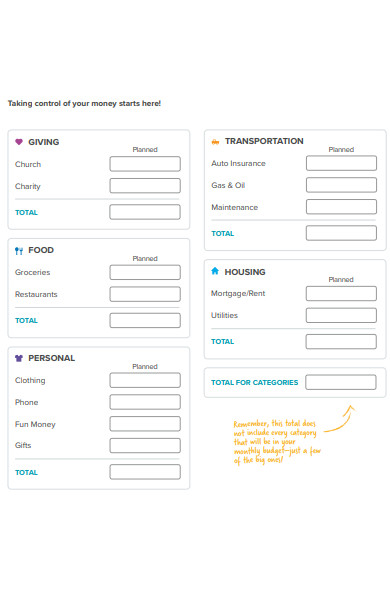

Free 52 Budget Forms In Pdf Ms Word Xls

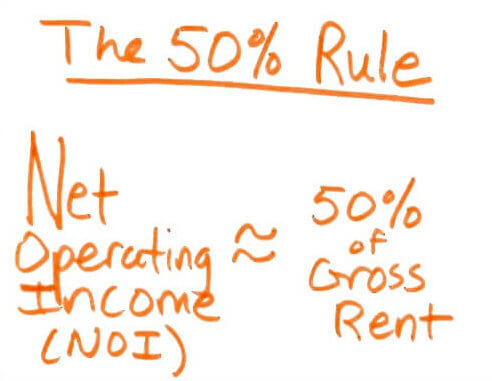

How Much Money Will I Make From My Rental Property Rich On Money

How To Run The Numbers For Rental Properties Back Of The Envelope Analysis

Solved Rental Income Below Fair Market Value

Late Rent And Mortgage Payments Rise The New York Times

Can You Claim Rental Mortgage Interest As An Itemized Deduction

Free 52 Budget Forms In Pdf Ms Word Xls

Why Does Renting Cost Twice What A Mortgage Payment Does Quora

Is Mortgage Payment For Rental Tax Deductible Fox Business